The S&P 500 index is one of the leading benchmarks of the overall market, to which all other investments are compared. It captures 80 percent of the market cap of the stock market.

The breakdown of sectors includes the following:

- Information Technology – 19.9 percent

- Health Care – 15.8 percent

- Financials – 13.7 percent

- Consumer Discretionary – 9.9 percent

- Communications Services – 9.9 percent

- Industrials – 9.4 percent

- Consumer Staples – 7.4 percent

- Energy – 5.4 percent

- Utilities – 3.1 percent

- Real Estate – 2.9 percent

- Materials – 2.6 percent

The 10 largest companies of the S&P 500 index as of January 2022. This list and its sequence can, and probably will, change over time.

- Apple (NASDAQ:AAPL)

- Microsoft (NASDAQ:MSFT)

- Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG)

- Amazon (NASDAQ:AMZN)

- Tesla (NASDAQ:TSLA)

- Meta Platforms (NASDAQ:FB)

- Nvidia (NASDAQ: NVDA)

- Berkshire Hathaway Class B (NYSE:BRK.B)

- Tesla (NASDAQ:TSLA)

- JPMorgan Chase (NYSE:JPM)

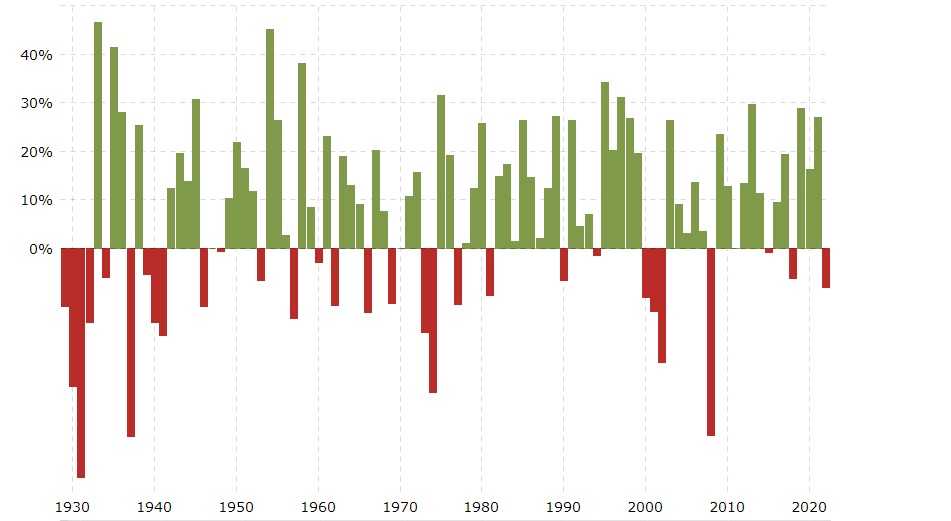

S&P Annual Returns

For the past 52 calendar years, from 1970 through 2021, the S&P 500 compounded at 11%. An initial investment of $100,000 in 1970 would have grown to $23.1 million by the end of 2021. The S&P is likely to give a return of 8-10% this year. For short term and long term plays, subscribe to our newsletter!